crypto tax calculator uk

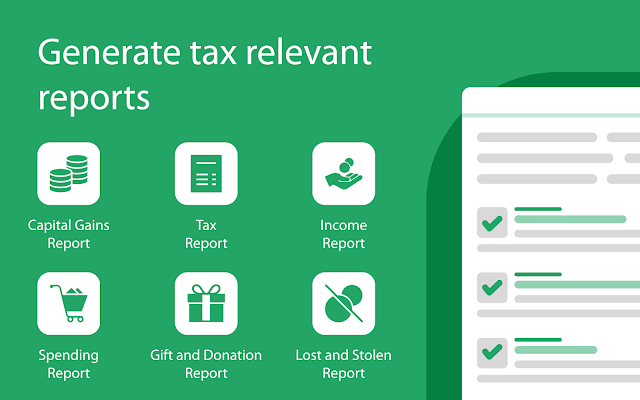

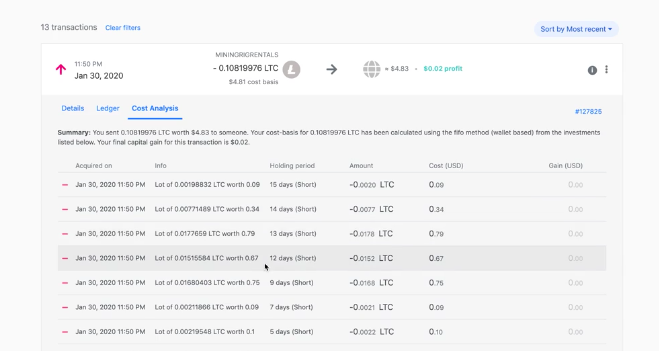

It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. Capital gains tax report.

Calculate Your Crypto Taxes With Ease Koinly

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

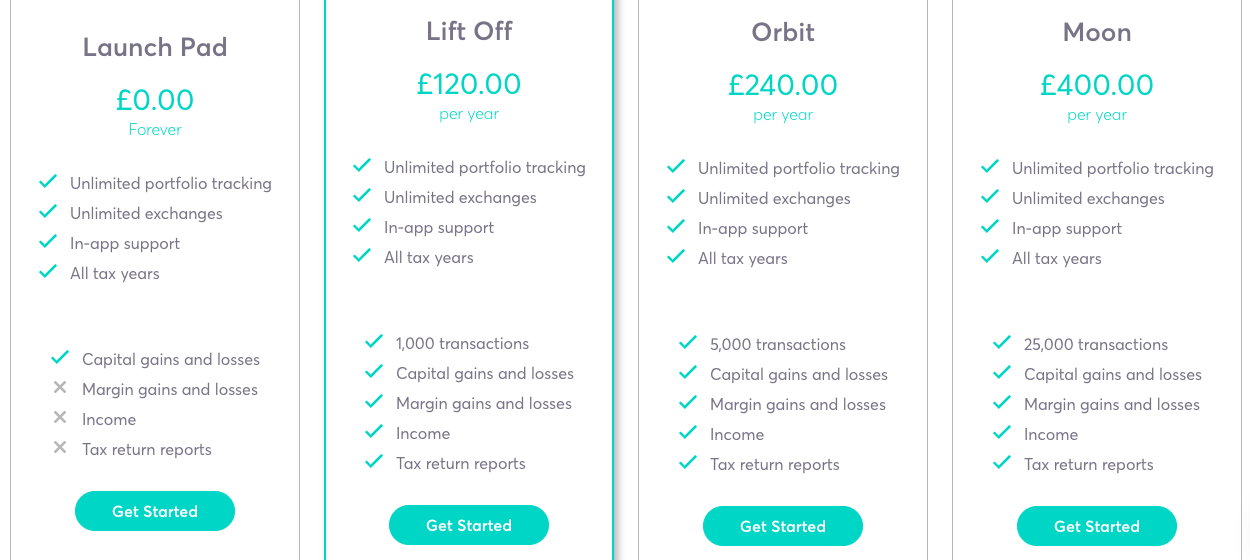

. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Koinly is a popular offering which allows users to prepare crypto tax reports for many jurisdictions including the UK.

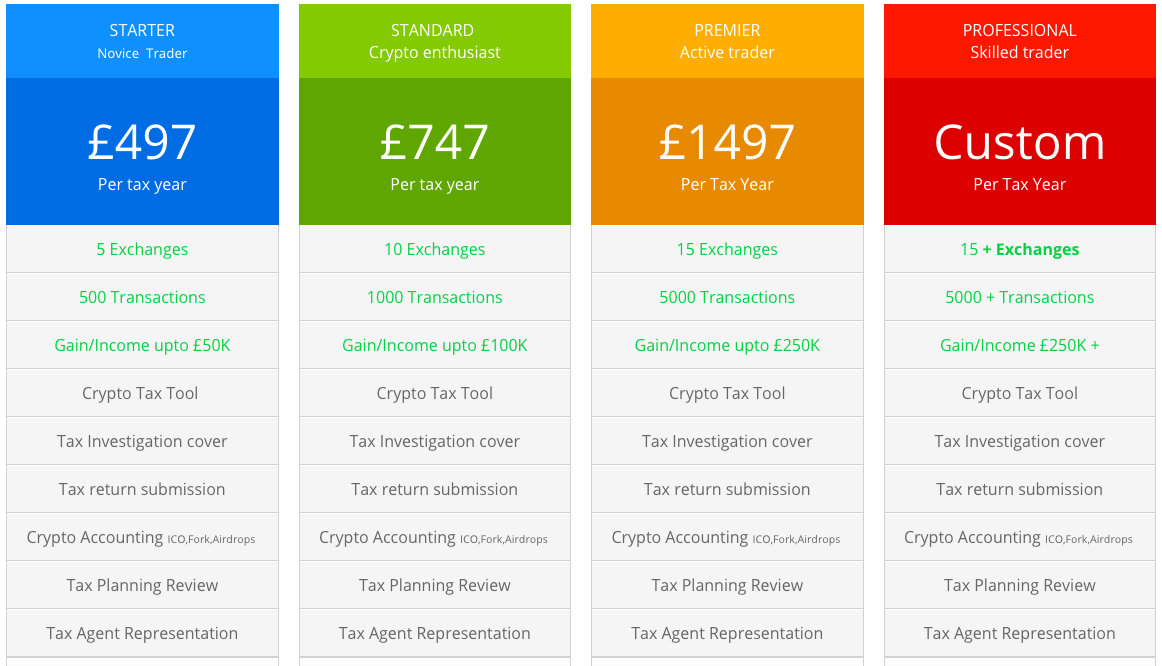

UK citizens have to report their capital gains from cryptocurrencies. Create your free account now. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

Guides and tips to assist with the generation and submission of reports. The best crypto tax app with very helpful support staff. 13 articles in this collection.

The tool has an enormous number of exchange wallet and blockchain connections and even allows you to connect to other crypto tax calculators and savings products like BlockFi and Nexo. The user interface is intuitive and easy to use but also powerful and allows you to drill into the minutia when needed. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Youll then need to file and pay your Capital Gains Tax bill by 31st January each tax year. For example Australias ATO Australian Tax Office the UKs HMRC Her Majestys Revenue and Customs both use different tax metrics. The platform is also to start using Koinlys crypto tax calculator.

Calculate and report your crypto tax for free now. You simply import all your transaction history and export your report. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

CoinTrackinginfo - the most popular crypto tax calculator. 20 28 for residential property for your entire capital gain if your overall annual income is above the 50270 threshold. CSV support if your exchange is dead.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day. For the 202223 tax year you pay CGT at the following rates. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

File your crypto taxes in the UK Learn how to calculate and file your taxes if you live in the United Kingdom. It takes less than a minute to sign up. Straightforward UI which you get your crypto taxes done in seconds at no cost.

56 1003 PM Aug 3 2022 Twitter Web App. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day. Easily obtain all the relevant information to file your Self Assessment Capital Gains Summary SA108 to be included with your SA100 Self Assessment Tax Return.

Generate capital gains and income tax report on all your crypto transactions in accordance with HMRC guidelines. Easily file all your crypto taxes in the UK. When it comes to crypto you can earn up to.

Written by Layla Huang Patrick McGimpsey David Melbourne and 1 other. How to calculate your UK crypto tax. Ive tried a few different crypto tax apps and this one is easily my favourite.

Capital Gains Tax is a tax you pay on your profits. Get started for free. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes.

Start for free pay only when you are ready to generate your. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Private by design - all data encrypted by you and never seen by us or anyone else.

In the UK you may have to file a Negligible Value Claim in order to claim any stolen or hacked assets as a capital loss. How to calculate your UK crypto tax. You can discuss tax scenarios with your accountant.

The rate of CGT that you pay each year depends on the asset youve sold and how much you earn. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

FTX Binance Coinbase Kraken Luno Uphold and many more. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. You declare anything youve earned from selling an asset over a certain threshold via a tax return.

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Cryptocurrency Tax Calculator Forbes Advisor

Calculateme Com Calculate Just About Everything Area Of A Circle Gas Mileage Calculator

Bitcoin Taxes Crypto Portfolio Prices Cointracker

Cryptoreports Google Workspace Marketplace

How To Calculate Your Uk Crypto Tax

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

How To Calculate Crypto Taxes Koinly

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Net Income Tax Calculator Manitoba Canada 2020

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Capital Gains Tax Calculator Ey Global

Add Your Sources Of Cryptocurrency Income From The Tax Year Tax Software Cryptocurrency Taxact

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare